The global supply chain has never been an uncomplicated ecosystem, but 2025 has made it particularly unpredictable. From the unending U.S.–China tariff tension and changed consumer behavior to rising logistics costs, a number of companies are under a different kind of pressure: the need to be both efficient and resilient. Businesses that once relied on stable import routes or just-in-time practices are now rethinking everything from procurement to the location of production.

The End of Predictable Supply Chains

Up until 2020, global trade had a somewhat predictable cadence: goods flowed freely, delivery timelines were stable, and cost estimates were manageable. That world is gone.

The pandemic, wars, and economic policies have permanently rearranged the global flow of logistics. Suppliers in Asia are still often struggling with delayed shipments, higher prices for raw materials, and much tighter customs inspections. Companies that used to plan six months out now need to plan a year in advance, and still be agile enough to pivot overnight.

One key lesson from 2025 is that predictability no longer equals security. Even the most well-established routes, such as China–Europe or Pacific lanes, can suddenly become too expensive or delayed to sustain.

Nearshoring and Regional Diversification

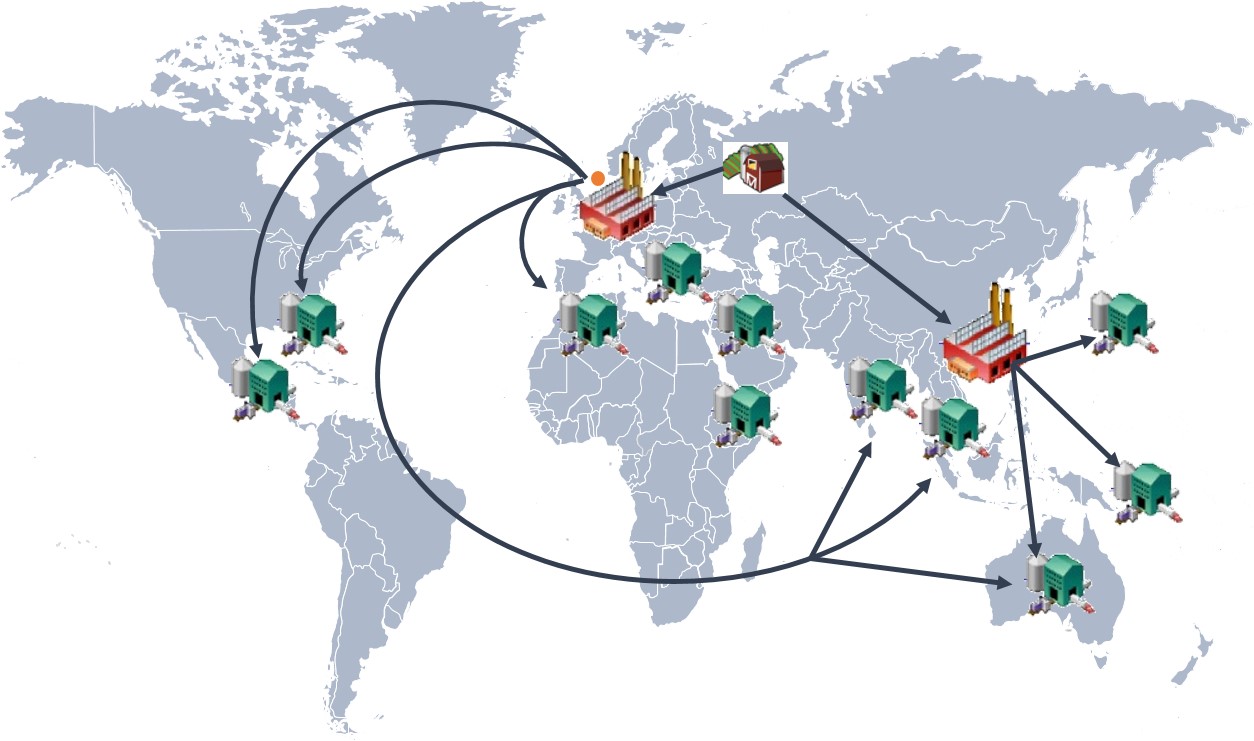

The risk concerns have prompted many companies to diversify their supply chains, not necessarily abandoning Asia but adding alternatives closer to home. European companies are seeking partnerships in Eastern Europe, Turkey, and North Africa. American retailers are sourcing from Mexico, Vietnam, and even domestic manufacturers. Besides reducing the dependence on long-distance routes, nearshoring will also enhance communication, lead time, and flexibility. While production costs may be a little higher, companies can, in turn, respond more quickly to market shifts-something especially valuable when customer preferences change in as few as a couple of days’ time.

Technology as a Risk Management Tool

By 2025, data visibility isn’t optional; it’s a must. Modern inventory management and order control systems provide real-time information to companies on the level of stock, movement of shipments, and performance of suppliers. Consequently, predictive analytics enables managers to surmise where shortages may occur and adjust accordingly before the crisis occurs.

Automation and AI-driven demand planning make it easier to dynamically adjust purchase volumes. Instead of being committed to one large seasonal order, retailers can place smaller orders more frequently based on live sales data. It not only minimizes overstock risk but also keeps cash flow healthier.

Financial Strategies for Volatile Times

Supply chain disturbances influence not only logistic issues but also financial ones: currency fluctuations, tariff changes, and unpredictable freight costs can wipe out profit margins in no time.

Smart companies are building financial buffers along with stock buffers: setting aside funds for emergency shipments or tariff surcharges. Some negotiate flexible contracts with suppliers to lock in partial pricing while keeping some margin open for changes.

A dynamic buffer strategy remains one of the most effective ways to survive the trials of volatility. It’s not hoarding resources; it’s protecting the ability to act quickly.

Building Long-term Resilience

Resilience doesn’t come from reacting faster; it comes from designing systems that absorb shocks naturally. That means forging close relationships with multiple suppliers, using transparent communication tools, and maintaining clear line-of-sight visibility across all inventory points. Businesses that focus on collaboration, not just transactions, will be in the best position to handle disruptions.

Why 2025 Is a Turning Point

The companies that will be the most successful in 2025 and beyond are not the biggest; rather, they are the most adaptable. Those that are diversifying their sourcing, using technology smartly, and maintaining flexible inventory strategies are turning uncertainty into opportunity.

If there’s one takeaway from this year’s supply chain turbulence, it’s this: resilience is now the most valuable business asset. Efficiency still matters, but only when combined with agility.