FairMoney Microfinance Bank Mission Is to Accelerate Nigeria Financial Inclusion

FairMoney Microfinance Bank's Mission Is to Accelerate Nigeria's Financial Inclusion

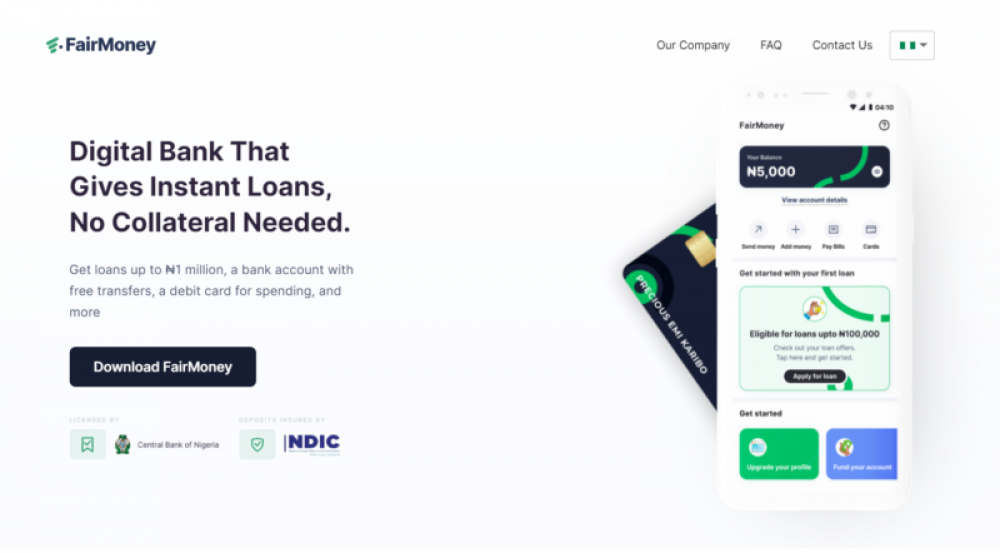

Customers in Nigeria can get instant loans and bill payments through FairMoney, which began operations in 2017 as an online lender. Founded by Laurin Hainy, Matthieu Gendreau, and Nicolas Berthozat with the overarching vision of becoming the leading digital bank in Nigeria and advancing financial inclusion for the average Nigerian, FairMoney has grown to become one of the world's most successful fintech companies.

Real-time transfers, instant loans, fast payments, and the new age of banking enjoyed by developed countries were the driving forces behind the creation of FairMoney. The company was founded out of a burning desire to bridge the divide between developing African countries – including Nigeria – by putting banking in your hands, enabling real-time transfers, instant loans, fast payments, and the new age of banking enjoyed only by developed countries.

FairMoney was established with a focus on the needs of the majority in order to meet the primary needs of the Nigerian market – small and medium-sized businesses – through quick and seamless loan processing.

FairMoney MFB has grown its customer base to more than 5 million users and 2 million bank accounts in its four years of operation as a result of following this business strategy. It has disbursed over N117 billion as a result of its persistent positioning as the New Bank for the Masses–with plans to serve the unbanked and underbanked–and its commitment to serving the unbanked and underbanked.

Words from Laurin Hainy, FairMoney's Co-Founder/CEO

In the words of Laurin Hainy, FairMoney's Co-Founder/CEO, "FairMoney is positioned to support our customers across a wide range of financial service needs while also working to maintain our current position as Nigeria's leading digital bank." FairMoney is a financial technology company that was founded in Nigeria. As a company, we have always had the goal of meeting the needs of the greatest number of Nigerians possible. Our goal is to provide millions of Nigerians with loans and capital to meet their immediate needs while also enabling them to start or expand their businesses.

We were established to assist entrepreneurs in growing their businesses, and we have disbursed over N117 billion in loans since our founding."

FairMoney has carved out a niche as a leading driver of financial inclusion in Nigeria through its innovative lending service offerings, which allow customers to secure loans without the need for collateral in as little as five minutes. As an added bonus, it provides users with free debit cards and free inter-bank transfers, allowing them to continue to support small and medium-sized enterprises (SMEs) while alleviating the common expenses incurred by traditional banks due to account maintenance fees.

In addition to its many other services, FairMoney offers the digitization of general banking procedures through its app, which enables bill payments to be made without having to visit a banking hall. Additional initiatives aimed at empowering consumers, such as the recently concluded FairMoney Transact & Win Black Friday campaign, which saw ten lucky winners walk away with smartphones, five generators, and a delivery motorcycle;

As part of their effort to provide equal opportunity for all and to uphold their promise of Fair banking for all, they are also running ongoing Christmas giveaways known as the '12 Days of Fair Giveaways.'

Words from Nengi Akinola, Head of Marketing and Branding at FairMoney

According to Nengi Akinola, Head of Marketing and Branding at FairMoney, the company's commitment to Nigerians has been reaffirmed:

"At FairMoney, our vision is a world in which everyone has equal financial opportunities and support in order to achieve their financial goals, no matter how large or small they may be." According to her, "We will continue to expand our offerings in order to better meet the ever-increasing needs of the average Nigerian customer." In a statement, Nengi said, "We're excited to share all of the exciting new features that will be added to the FairMoney app in the coming year."

Fair banking for all, according to some, is the future of the banking industry. What FairMoney has in store for us is something we can't wait to see, and it all starts with a single simple step: downloading the FairMoney app or visiting the FairMoney website.