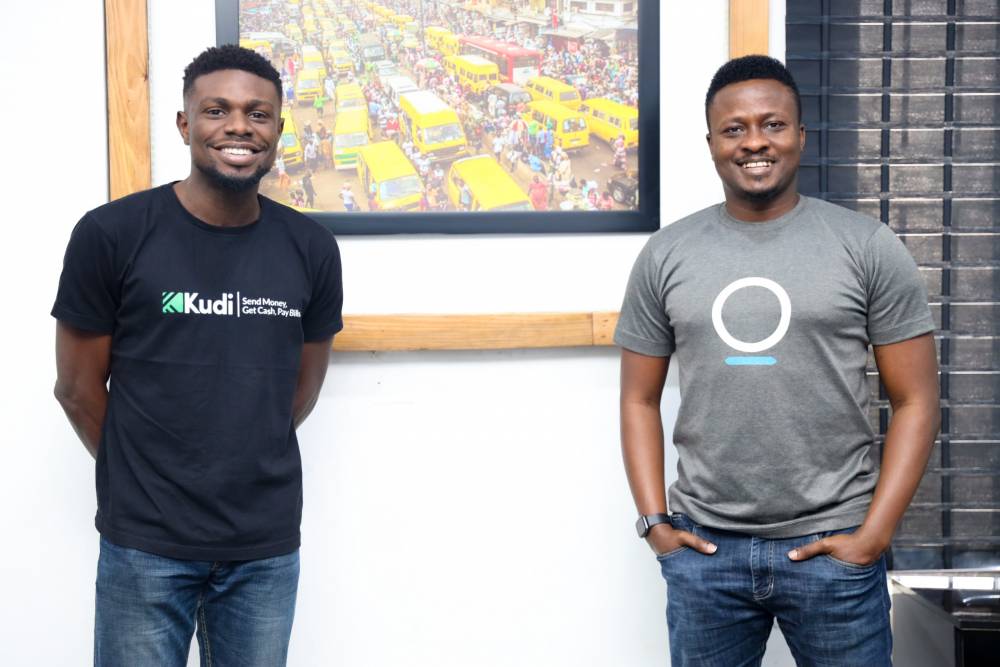

The Collaboration of Kudi and Onepipe Providing Financial Access to Millions of Customers in Underserved Areas of Nigeria

The Collaboration of Kudi and Onepipe Providing Financial Access to Millions of Customers in Underserved Areas of Nigeria

OnePipe, a fintech infrastructure startup, has partnered with Kudi, a payments service company, in order to provide more inclusive financial services to millions of underserved customers across Nigeria through the Kudi Benefits Account, which will be available in the coming months.

OnePipe was founded in 2018 and, through its API-driven partnerships, is dedicated to assisting organizations in embedding and launching financial services such as accounts, improved payments, and credit into their products. Ope Adeoye, the CEO of OnePipe, emphasized the importance of existing financial services stakeholders collaborating with innovators in order to ensure that underserved Nigerians are included in the digital financial ecosystem. Using his words, "the collaboration of Polaris Bank, Migo, Zitra Investments (formerly known as Zitra Investments), Kudi, and, of course, OnePipe has birthed the value proposition that drives the Kudi Benefits Account."

The provisioning of full-fledged, regulatory compliant accounts is handled by Polaris through its digital banking platform Vulte, while lending resources are provided by Migo and Zitra Investments. All of this is brought together through OnePipe's versatile API gateway to create the Kudi Benefits Account – "a NUBAN enabled account that provides services and benefits to Kudi's unique customer base."

This collaboration with Kudi is expected to broaden financial access for millions of users who already rely on Kudi's payment service to withdraw cash, send cash, and pay their bills through its rapidly expanding network of over 50,000 Mobile Money Agents across Nigeria to conduct their financial transactions.

“It is important to us to continue to explore various channels to drive financial access to every Nigerian regardless of who they are or where they live,” Yinka Adewale, the CEO of Kudi, said in response to this partnership. With OnePipe's infrastructure and partnerships with Polaris Bank and others, we are now able to provide full utility, NUBAN bank accounts laced with a no-friction credit proposition to millions of users through kudibenefits.chat, and we will be issuing debit cards to millions of users in the near future, further expanding our service offerings to them.”

The Economic and Financial Inclusion Alliance (EFInA) recently reported that more than 38 million Nigerian adults still do not have access to digitized financial services. The need for increased efforts and more innovative solutions, such as the Kudi Benefits Account, to drive financial inclusion in Nigeria is highlighted by this situation.

About Kudi

For over a decade, Kudi has been a leading provider of cash collection, payment, and other banking solutions in Nigeria's underserved markets. Aiming to make financial services accessible and affordable to all Africans, Kudi provides millions of users with access to services such as cash withdrawals, money transfers, bill payments and top-ups of their wallets, among other things, through its rapidly expanding network of over 50,000 Agents.

About OnePipe

With the strong belief that the world requires a new type of financial services ecosystem, OnePipe is a mission-driven organization with a strong commitment to its mission. Everyone has a role to play, and everyone has something of value to capture in this world. Furthermore, while some gatekeepers are required, their influence should be kept to a bare minimum. As of August 2018, OnePipe has facilitated the seamless launch of financial services products by a diverse group of cross-industry entrepreneurs and entrepreneurs. In the month of June 2021, OnePipe successfully processed Embedded Finance transactions totaling over $5.6 million in value.