What You Need To Know About The New UBA Mobile App

What You Need To Know About The New UBA Mobile App

Although it had not previously appeared possible to have a seamless digital banking experience, the new UBA mobile app has made financial transactions much more enjoyable and nearly flawless. The new app, which was released this year as an upgrade to the previously existing one, contains a combination of traditional features as well as new and innovative features that have been upgraded and added.

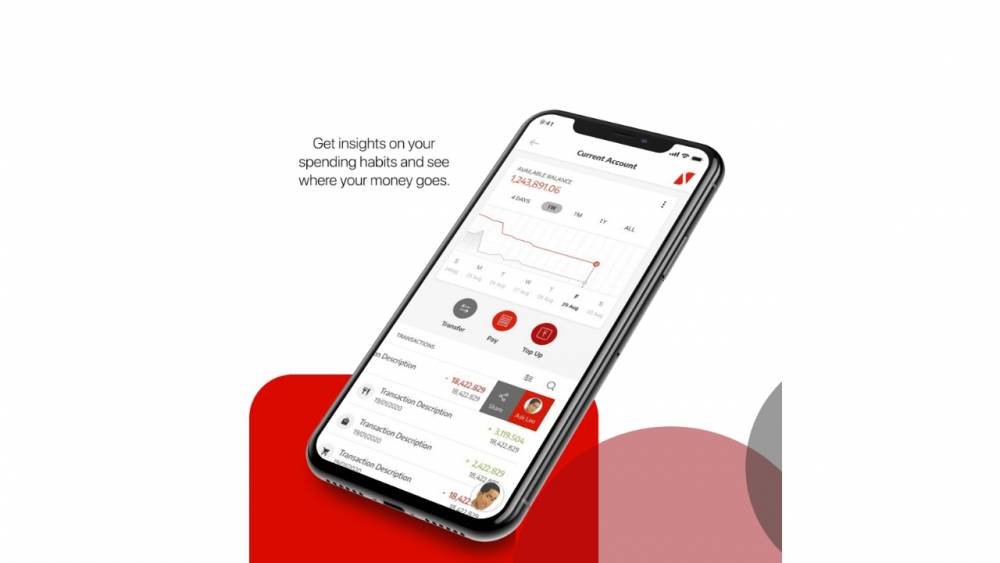

As a summary, the new app assumes the role of a Personal Financial Manager, allowing you to better plan your budget and finances while also allowing customers to view their expenses according to various categories, as shown below. It helps customers gain insight into their own behavior.

Along with the ability to manage multiple accounts under different account categories, customers can schedule bills to be paid at a later date or to be paid immediately; save for goals in a goal-oriented manner; and set a spending limit for their accounts, in addition to the regular bank app features such as making transfers and topping up airtime.

One of the most important features of the new app is the privacy feature, which allows you to conceal your account balance by waving your phone over the sensor while the app is open. This is a fantastic shortcut to have, especially in an emergency situation.

Availability of the App

The app is available in all 20 countries where UBA is present, making it possible to communicate in a variety of languages with other users. Customers in any of these countries, including Nigeria, will find it simple to locate nearby automatic teller machines (ATMs), as well as to lock, freeze, cancel, and block ATM cards linked to their accounts. Customers will also find it simple to locate nearby ATMs. It is possible to confirm cheques, request cheques, and stop cheques directly from the app.

In addition, UBA's loan platforms, known as "Click Credit," are available on the new app, with the option to borrow money restricted to salary earners only. If a customer's account is eligible for a loan, he or she can simply request the amount needed and click on the ‘Request loan' button.

It doesn't matter whether you already have a UBA account or not; downloading the app – which is available for both Android and iOS devices – is a good way to get started on your digital banking journey, which will leave you amazed and satisfied with your financial management decision.