South African Startup Ozow Has Raised $48 Million In A Series B Round Led By Tencent

South African startup Ozow has raised $48 million in a Series B round led by Tencent

South African payment gateway Ozow has raised $48 million in a Series B round of funding to expand the country's payment options. The funding will be used to further the company's growth.

Investors such as Endeavor Catalyst and Endeavor Harvest Fund participated in the funding round, which was led by Tencent, the Chinese internet giant.

Among the other investors, Tencent provided a $20 million lead investment, accounting for nearly half of the total funds raised. The remaining funds came from other investors.

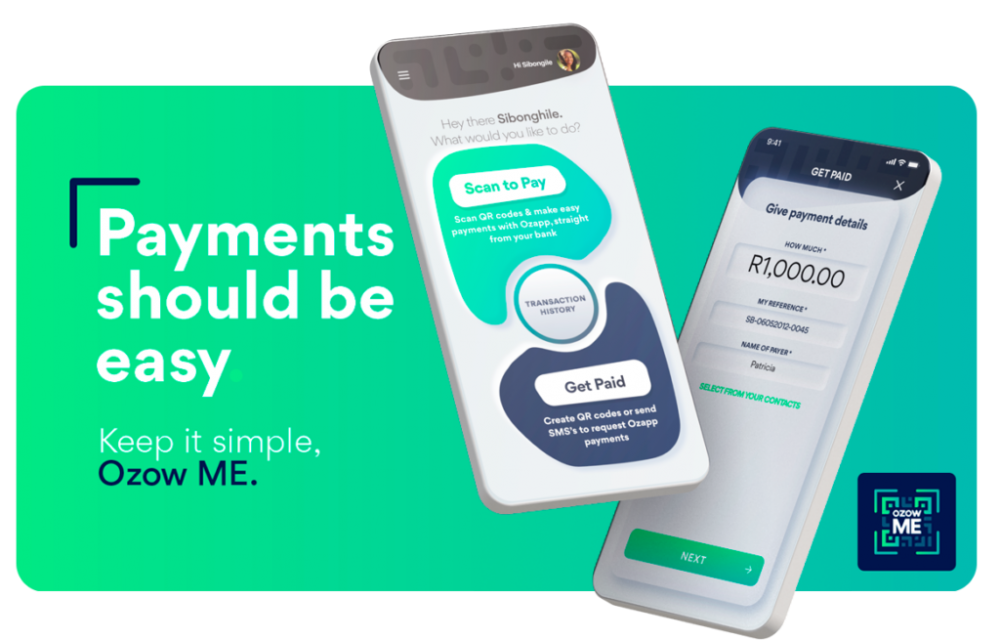

The company accepts alternative payment methods throughout South Africa, including QR codes, point of sale, e-commerce, e-billing, and peer-to-peer (P2P) payments.

With the new funding, Okow will be able to expand its product offering and promote greater financial inclusion in the country as a result of its success.

Additional strategic investments, such as mergers and acquisitions, are being considered by the company to aid in the development of new products and the expansion of the company's operations into additional African countries such as Namibia, Ghana, Nigeria, and Kenya over the next six months.

Ozow, formerly known as i-pay, was founded in 2014 by CEO Thomas Pays with the goal of promoting financial inclusion through open banking. Following the completion of its Series A funding round in 2019, Ozow would eventually rebrand.

In South Africa, according to the company, it is working on developing automated bank-to-bank payment solutions for more than 47 million bank account holders and more than 100 different industries.

Online transactions have traditionally been conducted through manual EFT processes, but Ozow claims to automate the manual EFT process and "allow consumers to pay in three clicks."

At the moment, the platform serves more than 47 million people who have bank accounts. Merchants only require a bank account and a "smart-enabled device" in order to accept credit card payments.

As of today, Ozow serves a diverse clientele that includes Fortune 500 companies such as MTN Corporation, Vodacom Corporation, Shoprite Group Corporation, Takealot Corporation, and Uber.

Additionally, distributors, payment service providers, and resellers of the company's merchandise are included in the network. They are assessed a percentage fee ranging between 1.5 and 2.5 percent of their gross revenue.

A $2.5 million Series A round of funding was raised by Ozow in 2019, and the company has grown at a rate of 100 percent year over year since then. A total of more than $100 million in transactions are processed each month from thousands of merchants by this company.

"It's a privilege to welcome Tencent, Endeavor Catalyst, and Endeavor Harvest Fund," said Ozow CEO Thomas Pays in an interview about the company's funding. This demonstrates our contribution to the transformation of the banking industry through the development of more innovative, convenient, and inclusive payment solutions for all.