Attention Required! Cloudflare

Additionally, the highest tier lets you create invoices and accept payments in multiple currencies, so this is a viable option for international businesses. The lowest tier is affordable, but the invoice limits are too limiting—your count applies to sending and approving invoices. QuickBooks will generate important reports that will provide you, your accountant, and your banker important insights into the financial health of your business. This QuickBooks tutorial will teach you the importance of and how to print the profit and loss report, balance sheet report, statement of cash flows, and A/R and accounts payable (A/P) aging reports. By using QuickBooks Payroll, all your wages, salaries, and payroll taxes will be included automatically in your financial statements. After this lesson, you’ll be able to set up employees in QuickBooks, enter and run payroll, pay employees by direct deposit or check, and reconcile your payroll taxes.

Lenders often require financial statements when you apply for a small business loan or line of credit. Nearly 70% of business owners who have been there, done that, recommend writing a business plan before you start a business. All QuickBooks Online plans come with a one-time Guided Setup with an expert and customer support.

QuickBooks Options & Pricing

QuickBooks Online is a cloud-based software that can be accessed anytime and anywhere from any internet-enabled device and has monthly subscription options. Meanwhile, QuickBooks Desktop is an on-premise software that needs to be installed on the computer where you use it and is available as an annual subscription. For picking the best health insurance for 2015 more information about the differences between the two programs, read our QuickBooks Online vs QuickBooks Desktop comparison. QuickBooks Online is a cloud-based product that doesn’t require software installation, allowing you to access your data from any computer with an internet connection by using your secure login.

- QuickBooks Online is the most versatile and well-rounded of the QuickBooks suite of products.

- It allows you to connect to your business apps and create reports to gain business insights to make smarter financial decisions for your small business.

- According to a recent study by the National Bureau of Economic Research, as many as 15% of workers in the United States may fit into that category.

- But there isn’t just one version of QuickBooks—if QuickBooks Online doesn’t work for you, another one of the six different versions of QuickBooks could.

- Quicken is more for home use than business use, but it can be helpful for tracking expenses, especially when your expenses are mixed, such as for those who own and manage rental properties.

QuickBooks Desktop plans also cost an annual fee per user, and most plans only allow for up to five users. Next, you can customize invoices, set up automatic sales tax tracking (if necessary) and learn how to enter mobile receipts and bills. You can edit all of your business’s account settings using the gear icon in the upper right corner. Has robust reporting tools and report customization options, invoicing for an unlimited amount of clients, inventory tracking in higher tier plans, plus a capable mobile app. Compared with QuickBooks, Xero’s plans and pricing structure are simpler and less expensive.

Track Inventory

While QuickBooks Online is only 50 cents more than Xero, note that that is the introductory cost for the first three months. QuickBooks Online goes to $30 per month after that and is easily our most expensive option. While QuickBooks Online is very popular among business owners, some have problems with the system. Problems stem from the complexity of making simple fixes, such as miscategorizations or duplicate entries. Support is limited, so users are left reading help articles rather than getting a live person to help.

There are multiple subscription plans available starting at $3.99 per month (if paid annually), but the best option for microbusinesses is the Home & Business plan at $9.99 per month (paid annually). All of these options are available at discounts of up to 40 percent discount thanks to a current promotion available from Quicken. Full accounting departments are likely to appreciate the comprehensive features of QuickBooks Online. You can track income and expenses, send invoices and accept payments, handle tax deductions and track receipts and mileage, which are all available on all plans. Other plans include advanced features, such as bill management and time tracking, advanced analytics and workflow automations.

Taxes done for you

QuickBooks Enterprise offers around 200+ industry-specific reports to Premier’s 150+ financial reports. It also includes more advanced customizations and inventory management features. And with up to 40 users, it works best for big businesses that emphasize financial collaboration and can shoulder the higher cost of an enterprise-level solution. Competitors can offer plans with lower monthly fees and similar features. For example, Xero ranges from $13 to $70 per month and includes unlimited users and basic inventory management in all plans.

- In addition to some native QuickBooks Online integrations—such as QuickBooks Payroll, QuickBooks Time, and QuickBooks Payments—QuickBooks Online connects with popular apps.

- To get a free consultation, simply fill out the form at the top of this page and a specialist will get back to you.

- Organise your finances in one secure, automatically backed up place and work anytime from any device.

- QuickBooks small business accounting software is an online accounting software that helps you maintain your book of accounts online from multiple devices.

- Many providers are offering discounts for the first few months when purchasing an annual plan, which we also found attractive.

In particular, you can only generate annual financial reports, not month-to-month reports, which complicates making wise financial decisions that benefit your business. QuickBooks’ self-employed solution is also more expensive than some other self-employed accounting software—and it has fewer features, too. (Crucially, its invoices are fairly standard and not very customizable.) If you want to do more than file taxes, even as a sole proprietor, QuickBooks Online is honestly a better fit. All plans include access to QuickBooks Online mobile apps, customer support and third-party app integrations.

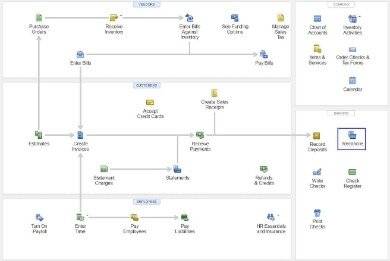

Setting Up QuickBooks

It allows you to connect to your business apps and create reports to gain business insights to make smarter financial decisions for your small business. QuickBooks small business accounting software is an online accounting software that helps you maintain your book of accounts online from multiple devices. It is based securely in the cloud and allows your employees to access your business' financial data anywhere, anytime. QuickBooks Online is one of the preeminent cloud-based accounting software platforms on the market.

Related Courses and Certification

Also Online IT Certification Courses & Online Technical Certificate Programs