From IPhone Shortages To Price Surges: The Global Chip Scarcity Is Affecting Africa

From iPhone shortages to price surges: The global chip scarcity is affecting Africa

Egypt's automobile manufacturers have been forced to curtail production due to a recent shortage of electronic control units (ECUs), which are critical components of vehicles' electrical systems. In South Africa, more than 20,000 customers who signed up for Supersonic's Unlimited Air Fibre service have been waiting to be connected since February, as the company continues to face supply chain issues.

The aforementioned companies operate in two distinct industries (automobile and information technology) and, aside from the consumers they serve, have little in common. However, they, like many others in a variety of industries throughout the world, have seen their businesses disrupted by the same issue.

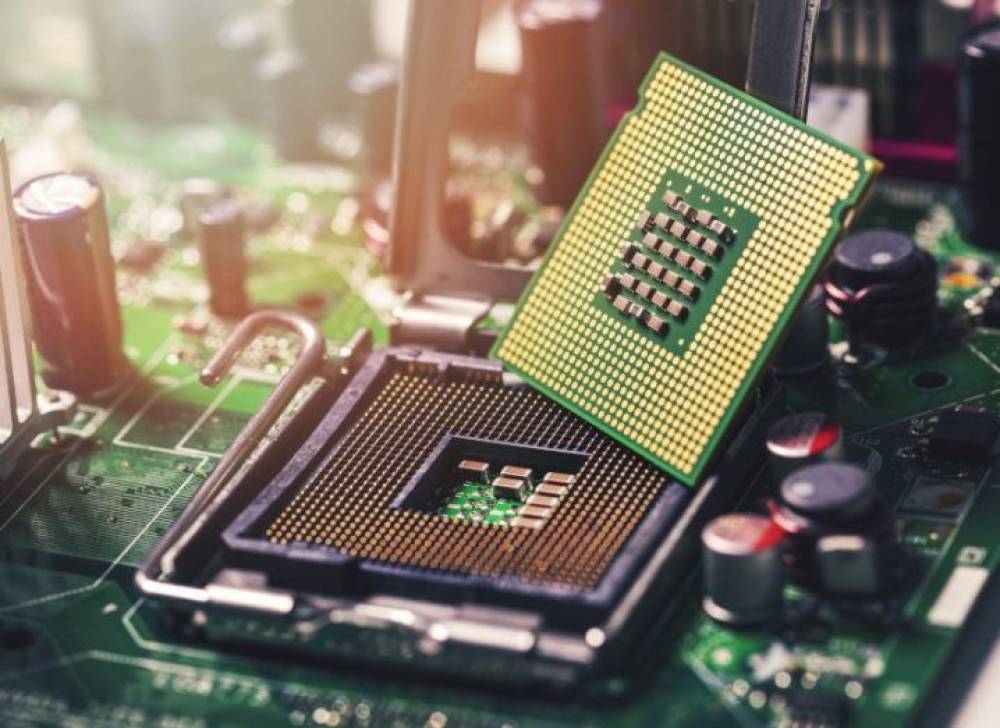

Globally, technology companies have recently faced a shortage of one of the smallest components used in the production of millions of tech products each year – semiconductor chips.

Months into the shortage, the effects have spread widely across industries and the globe. Automotive and consumer hardware manufacturers have been hit the hardest, and those operating in Africa have not escaped unscathed.

Mustek, Rectron, and Homemation, South Africa's Acer distributors, told ITWeb that the severe shortage has impacted all industry verticals, resulting in a shortage of laptops, tablets, printing and scanning equipment, and peripherals.

Price jumps as over 100 industries suffer

According to Goldman Sachs, a US investment bank, semiconductor scarcity affects a staggering 169 industries in some way. This is because chips are more widely used nowadays. They were previously found only in personal computers and mobile phones. As a result of rapid technological advancements, semiconductors are now found in everything from automobiles to washing machines.

Manufacturers have struggled to meet the massive demand in recent months, a problem attributed in part to supply chain disruptions caused by national Covid-19 lockdowns, uncertainty surrounding the US-China trade war, and a drought in Taiwan, home to the world's largest semiconductor manufacturer.

Taiwan, in fact, is one of four Asian countries that account for nearly three-quarters of the world's semiconductor manufacturing capacity. Only two of these countries produce the most advanced chips.

Taiwan Semiconductor Manufacturing Company (TSMC) alone supplies 92 percent of cutting-edge chips globally – Samsung supplies the remaining 8% – and 60 percent of chips used by automobile manufacturers. This limits companies' options for obtaining chips when producers reach capacity and raises concerns about the concentration of chip manufacturing in a small number of countries.

Apple, the largest technology company in the United States, has been significantly impacted, as it is one of TSMC's largest clients. In South Africa, numerous stores operated by the company's authorized reseller, iStore, have reportedly encountered iPhone stock shortages. Meanwhile, TechCabal was unable to reach iStore's Nigerian subsidiary for comment at the time of publication.

According to economics' law of demand and supply, when there is scarcity, the price of a product must increase, assuming all other variables remain constant. Thus, the global chip shortage has naturally resulted in price increases, and local players have little recourse.

“These are not components that domestic automobile manufacturers can manufacture,” Khaled Saad, head of the Egyptian Association of Automobile Manufacturers, reportedly told local press. “The issue is already putting upward pressure on domestic car prices, and it is expected to continue to do so.”

Numerous reports indicate that many independent retailers in South Africa are now selling well above the suggested retail prices by manufacturers.

According to Mustek CEO David Kan, the current shortage is the worst in over three decades. “In my 34 years in the information technology industry, I have never encountered or witnessed such shortages. Pricing has skyrocketed!”

Any end in sight?

Global chip shortages continue to be a multifaceted issue.

At the start of the year, there was optimism that supply chain issues would be resolved by summer. However, even though summer does not end until September, it is improbable that this will be the case.

In addition, industry analysts cannot agree on an end date for the shortage, with predictions ranging from the second half of 2021 to the beginning of 2022. According to some experts, the crisis's effects could last well into 2023. However, the general consensus appears to be that things will deteriorate further before they improve, as there is no quick fix.

Several global chipmakers – including TSMC, Samsung, and Intel – are already investing in capacity expansion and production ramp-up. The United States is also pursuing billion-dollar investments in its semiconductor manufacturing.

In Africa, Dedan Kimathi University of Technology in Kenya partnered with American firm 4Wave Inc earlier this year to open the country's first semiconductor factory.

A future partnership between local car agents and brand owners to establish local manufacturing facilities for high-tech components such as semiconductors is also being discussed among Egypt's automotive stakeholders.

However, these actions will have little immediate effect on resolving the crisis, as the investments will take months, if not years, to mature.

For the time being, tech products will continue to compete for scarce chips, manufacturers will face production delays, and consumers will face shortages and price increases.