Everything You Need To Know About Carbon, The Online Lending Platform

Carbon - One Finance

There will always be times when you'll run out of money and would need to purchase something either for yourself or for a particular urgent purpose. While borrowing from others may be sufficient, why would you want to do so when there is an app like Carbon available?

Carbon is a popular lending platform that connects you to loans that you can afford to repay when the time is right for you. It's an easy-to-use app that relieves the stress associated with paper work and other administrative tasks. Carbon and its characteristics will be discussed in detail in this article.

- About Carbon (formerly Paylater)

- How to Submit an Application for Loan on Carbon

- How to Repay a Carbon Loan

- Payments are made automatically

- Make your payment with a credit or debit card that is not linked to your Carbon Account

- Repay Carbon via Bank Transfer

About Carbon

Prior to becoming what we know today, carbon underwent a number of transformations. One Credit was the name of the company that launched Carbon in 2012. One Credit was a company that provided loans exclusively to salaried individuals at the time. When I was younger, there was a paper-based application process in place, and those applying for loans were required to submit supporting documentation. One Credit was renamed OneFi in 2015 after a period of transition.

Because of the introduction of the Central Bank of Nigeria's Bank Verification Number (BVN) and national credit bureau services, the company was able to expand its services and provide more loans to a wider range of customers.

Payment processing company Paylater rebranded as OneFi in 2016, and the company made the decision to leverage technology to improve its services, allowing users to more easily access credit. This resulted in the development of the Paylater app, which was the first of its kind in the industry.

Paylater has since grown to include a variety of new services, including payments, investments, and personal finance management.

The platform, in essence, provides users with loans that are approved in a short period of time.

How to Submit an Application for Loan on Carbon

You must first download the Carbon app in order to begin borrowing from it. Carbon is available for download from the Google Play Store and the Apple App Store, respectively. Following that, you can use the app to apply for loans as follows:

1. To get started, sign up for a Carbon account. You'll be required to provide information such as your name, email address, and phone number during the registration process.

2. Using the camera on your phone, take a photo and upload it to the application.

3. Select your preferred loan type from the drop-down menu and follow the on-screen instructions. After that, press the Submit button.

4. After that, you'll need to enter the card information that will be used to pay back your loan. In addition, you must choose a repayment schedule.

5. Maintain your composure while your loan application is being reviewed. Once your application has been approved, the funds will be deposited into your account. This will take absolutely no time at all, as it will be sent to you within a few minutes of your application being submitted to the system.

When you have received your money in your Carbon account, you can transfer it to your personal bank account or use it to make other purchases through your Carbon account.

However, if you are applying for the first time, you may not be eligible for a loan of up to 1 million Naira, but if you have a good earning record, you could be considered in no time, and must pay back within one year.

As you pay back your loans, you'll be able to access larger loan amounts and lower interest rates in the future.

The interest rate on a carbon loan can range from 5 percent to 15 percent, depending on the loan amount and repayment option chosen.

How to Repay a Carbon Loan

You have a number of options for repaying your Carbon Loan:

1. Payments are made automatically

Carbon requires you to enter your credit/debit card information into the app before you can be approved for a loan through the service.

You must provide your bank account information so that Carbon can automatically debit your account when the loan repayment is due.

Carbon will automatically deduct the loan balance from your account as the loan repayment date approaches.

2. Make your payment with a credit or debit card that is not linked to your Carbon Account

When you use Carbon, you can repay a loan with a credit or debit card that is either linked to your carbon account or not linked to your carbon account. Using credit/debit card that is not linked saves you the charges.

Here's how it's done:

1. Start by logging into the Carbon app or website with your Carbon credentials. Choose View Details from the drop-down menu next to your loan amount.

2. Specify the amount you wish to be reimbursed. Simply select Repay from the drop-down menu.

3. Select Make a Single Payment or Quickteller from the drop-down menu that appears and proceed to the payment page by entering your credit card information.

3. Repay Carbon via Bank Transfer

Furthermore, Carbon provides the option to repay your loan through a bank transfer. If none of the previously mentioned methods worked for you, this is another option.

You must have the Carbon account number in order to make payments, which can be done through your bank's mobile app or in person at a branch.

How to Get Carbon Referral Link

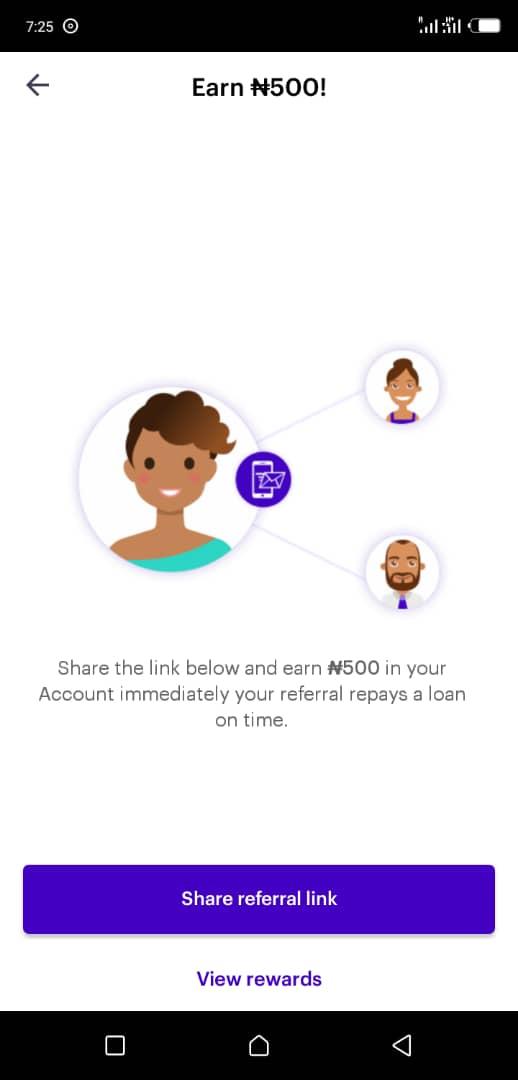

You can make money from Carbon, simply by sharing the referral link provided on the app.

Here are steps to getting the referral link and sharing to your friends:

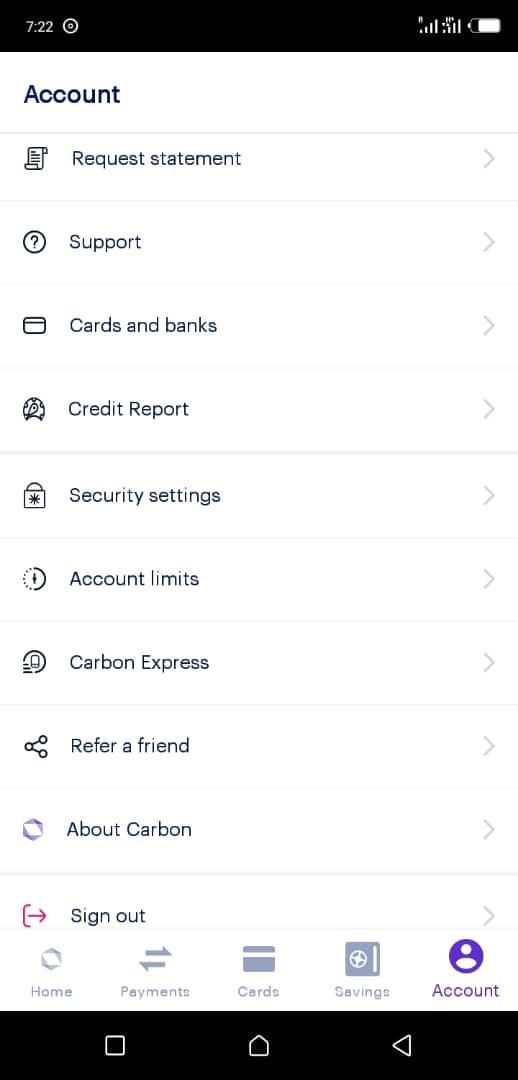

1. Logon to the Carbon App

2. Click My Account usually at the right top or right bottom

3. Click "Refer a friend"

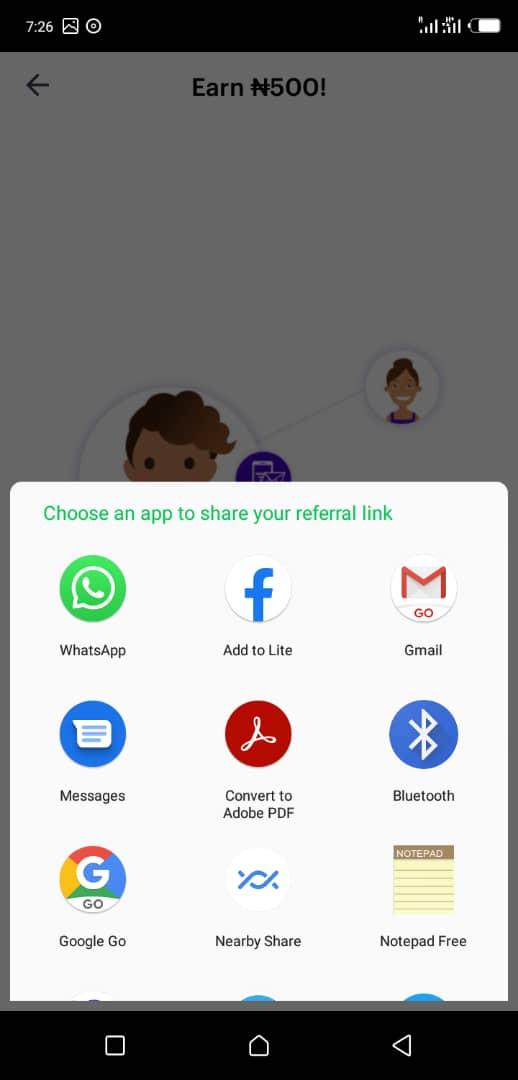

4. Click the "Share referral link" button

5. You will then see a list of social platforms with which you can share the link instantly to your friends and family.

If you need to Signup and Start Using Carbon Today, you can download the app and start enjoying the wonderful services carbon has to offer.

Carbon Products and Services

Here are List of Carbon Products/Services

online banking

personal loans

business/sme loans

online payment

send money

receive money

pay bills (cable, electricity, internet)

buy airtime

send airtime

buy data

send data

and lots more..

Carbon Authenticity

You may also be wondering if carbon is a reliable financial institute, here are reasons to see carbon as an authentic lending and financial platform:

Carbon is NDIC Insured.

Carbon is Licensed by the Central Bank Of Nigeria.

Carbon is KYC Compliant.