Bitcoin Price Plunges Even Lower As World’s Largest Crypto Exchange

Binance comes under probe in the US

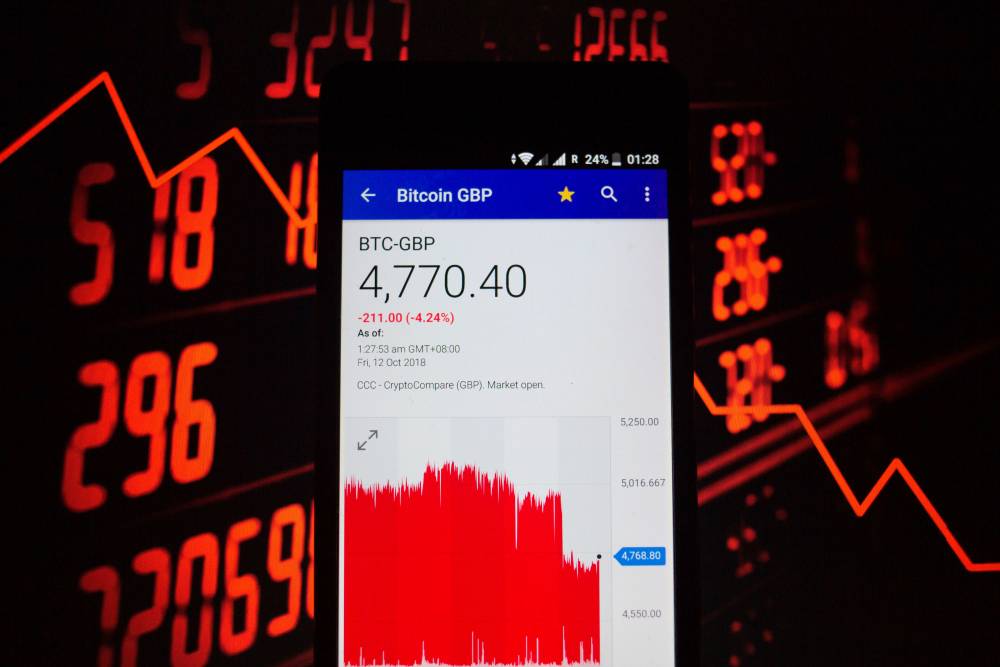

For the second consecutive day, the price of Bitcoin, the world's most valuable cryptocurrency, has declined. This comes amid reports that Binance, the world's largest cryptocurrency exchange, is being investigated in the United States for allegedly assisting money launderers and tax evaders.

Recall that Bitcoin fell by a whopping 16 percent yesterday to trade just under $51,000 after Elon Musk's Tesla announced that it would no longer accept Bitcoin for the purchase of its electric cars. Since the report of the Binance probe, the cryptocurrency has lost another 3% and is currently trading at $49,880.

This is probably an excellent time to purchase. Alternatively, you can sell, depending on which side you lean toward.

The Binance probe

Binance is currently under investigation by federal authorities in the United States of America for money laundering. The officials, who specialize in tax and money laundering, are looking for evidence that the company is being used to evade taxes and launder money in the United States.

Changpeng Zhao and He Yi founded the world's largest cryptocurrency exchange in 2017.

Except in the United States, the exchange is used globally. It began blocking accounts of users from the United States in November 2020 due to regulatory uncertainty from the authorities.

Why then is Binance being probed?

Chainalysis Inc., a blockchain forensics firm, concluded last year that more funds from criminal activity flowed through Binance than any other exchange. Numerous agencies, including US federal agencies, use chainalysis in investigations involving crypto.

Numerous officials in the United States have expressed concern that crypto is being primarily used for illegal transactions due to the lack of a digital footprint that can be traced back to the users. The investigation will determine whether the illegal activities originate in the United States or are perpetrated by US citizens despite their exclusion from Binance.

On Friday, cyber attackers forced Colonial Pipeline Co, the largest pipeline system in the United States for refined oil products, to pay a ransom of $5 million. The company paid the ransom in untraceable cryptocurrency after cyber terrorists infiltrated Colonial Pipeline's records with ransomware, preventing the company from conducting business as usual.

Along with the investigation into illegal money flows through the exchange, Binance is being investigated to determine whether it allows Americans to purchase derivatives linked to digital tokens. Residents of the United States are prohibited from purchasing these derivatives from companies that are not registered with the United States Commodity Futures Trading Commission (CFTC). Binance is not a CFTC-registered exchange.

Binance has not been charged with any wrongdoing as of yet

Although the crypto exchange is under investigation, it has not been accused of any wrongdoing, and this investigation may not result in any legal sanctions against it.

According to its founder, Changpeng Zhao, the company complied with US law by prohibiting Americans from using the platform. In reality, the ban took effect in November 2020. Zhao responded to news of the US investigation by tweeting that the company had committed no wrongdoing and had only "collaborated with law enforcement agencies to combat bad actors."

The US is not the first country to investigate a cryptocurrency exchange for tax evasion and money laundering. Kraken, a cryptocurrency exchange, is also under investigation by the US Internal Revenue Service (IRS).

The IRS filed a lawsuit seeking to examine the records of US cryptocurrency holders from 2016 to 2020, but it was dismissed in court due to the suit's broad timeline. However, in the first week of May, it obtained a court order allowing it to access Kraken's records containing the required information.

Between 2016 and 2020, the information sought will identify US taxpayers who traded at least $20,000 or its equivalent in cryptocurrency on the platform. Since 2020, the IRS has been sending letters to taxpayers requesting that they file tax returns on profits earned from cryptocurrency trading.

According to IRS Commissioner Chuck Rettig, "there is no justification for taxpayers to continue failing to report income earned and taxes owed on virtual currency transactions."

Similar to Binance's investigation, the Kraken case seeks to identify cryptocurrency trading that has not been reported for tax and income purposes.

If US traders are discovered on the Binance exchange and money laundering or tax evasion is detected, federal authorities may follow Kraken's lead by requesting the identities of the bad actors and enforcing appropriate sanctions.

Courses and Certification

Bitcoin Course and Certificate

Blockchain Technology Course and Certificate

Cryptocurrency Course and Certificate

Cryptography Course and Certificate