Forum Brands raises $27M Series A as crowded Amazon roll-up space continues to heat up

Forum Brands raises $27M Series A as crowded Amazon roll-up space continues to heat up

The number of startups that are acquiring e-commerce businesses, particularly those that operate on Amazon, in order to grow and scale is increasing as more people shop online than ever.

Forum Brands is the latest such startup to announce that it has raised $27 million in equity funding for its technology-driven e-commerce acquisition platform.

The round was led by Norwest Venture Partners and included existing backers NFX and Concrete Rose.

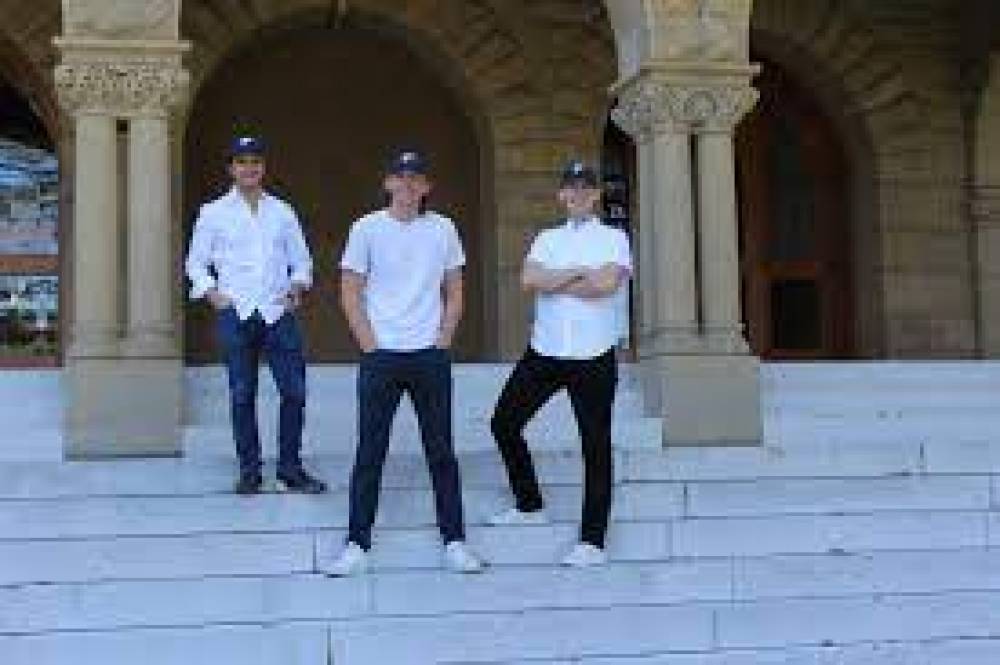

Brenton Howland, Ruben Amar, and Alex Kopco founded Forum Brands in New York last summer, at the peak of the COVID-19 pandemic. Its self-proclaimed mission statement stated that it would leverage data to innovate through acquisition.

“We're investing in what we believe are A+ high-growth e-commerce businesses that sell primarily on Amazon, with the goal of building a portfolio of category leaders, both on and off Amazon,” Howland explained. “A source of inspiration for us is our observation of how consumer goods and services have fundamentally changed over the last several decades, accelerating the shift toward digital.”

Forum's technology leverages "advanced" algorithms and more than 60 million data points to continuously populate a central platform with brand information, instantly scoring brands and generating accurate financial metrics.

Also, the M&A team leverages data to reach out to brand owners "in just three clicks." However, Forum asserts that it already knows which brands meet its acquisition criteria prior to contacting brand owners.

According to the company, “the decision to acquire occurs within 48 hours, and once terms are agreed upon, entrepreneurs receive payment for their brand in 30 days or less, with additional income benefits through post-acquisition partnerships.”

Its apps leverage analytics to make recommendations that help brands grow and perform financially. Then, through multichannel strategies, the company sought to position the brands for "long-term category leadership."

“We're leveraging a variety of data science and machine learning techniques to develop technology that will eventually enable us to operate a large portfolio of digital brands efficiently at scale,” Kopco explained.

The company is unafraid of the increasingly crowded space, believing that the market opportunity is so large that multiple players have plenty of room.

“We are very much in the early stages of e-commerce consolidation, and the market is enormous,” Amar told TechCrunch. “And, according to our data, approximately 98 percent to 99 percent of all sellers continue to operate independently. As a result, this is not a market in which the winner takes all. There will be multiple winners, and we have developed a strategy to ensure that we are one of them.”

Stew Campbell of Norwest Venture Partners believes that the number of sellers who encounter scaling difficulties due to a lack of resources or time will continue to grow. And Forum Brands intends to take advantage of it.

“There is a persistent need for additional liquidity options for the entrepreneurs who power many Amazon-first brands. The forum enables entrepreneurs to recognize value, which can be significant for a large number of them,” he explained. ”Following acquisition, the Forum team leverages operational efficiencies and scale to improve the shopper experience on Amazon.”

Campbell emphasizes that his firm was attracted to Forum Brands because of its team, which the company touts as a differentiator.

Kopco, Forum's co-founder and COO, spent several years at Amazon in a variety of product roles, and Jon Derkits, Forum's VP of brand growth, is also an ex-Amazon employee. Three-fourths of its operating team is comprised of former Amazonians. Howland served as an investor at Cove Hill Partners for two years and is a former McKinsey consultant. Prior to co-founding Forum, Co-CEO and co-founder Amar worked at TA Associates as a growth equity investor.

Campbell notes that his firm has observed numerous other models in this market, “but the Forum team combines long-term thinking and a strong focus on technology with operational and M&A expertise.”

If this all sounds familiar, it's because TechCrunch recently covered the initial public offering of Acquco, a company with a similar business model to Forum Brands that also employs former Amazon employees. That startup raised $160 million in debt and equity in May to expand its operations. Thrasio is another prominent player in the space, having recently raised $850 million in funding. Several other startups have recently raised venture capital, including Branded, which raised $150 million to launch its own roll-up business, as well as Berlin Brands Group, SellerX, Heyday, Heroes, and Perch. Additionally, Valoreo, a Mexico City-based acquirer of e-commerce businesses, announced a seed funding round of $50 million in February.

In Conclusion

Likewise, Moonshot Brands announced a $160 million debt and equity financing earlier this month in order to “acquire high-performing Amazon third-party sellers and direct-to-consumer businesses on Shopify and WooCommerce with established brand equity.” According to the company, it has achieved a $30 million revenue run rate since its founding in 2020. Y Combinator, Joe Montana's Liquid 2 Ventures, and the founders of Hippo, Lambda School, and Shift are among its investors.

Courses and Certification

Amazon Web Services - AWS Course and Certificate

E-Commerce Course and Certificate

Business Analytics Course and Certificate

Business Intelligence Course and Certificate

Fundamentals of Science and Technology Course and Certificate