Fundamental Analysis Meaning, Basics, Types & Examples

Contents:

On the other hand, top-down investors consider the broader market and economic conditions when choosing stocks for their portfolio. Bottom-up investors focus on a specific company and its fundamentals, whereas top-down investors focus on the industry and economy. These investors distinguish themselves by a ‘short term ‘ approach, the market is a voting machine and not a weighing machine. Own decisions are made because of which signals from the market are ignored. Investors believe in active steering between ‘good’ companies, as a result of which an investor will grow with the company.

The business model is based on the prospects, goals, technologies used, innovations, patents, and tools. The more thoughtful the business model, the more likely the company’s stock price will continue to rise. Fundamental analysis is price forecasting based on analysis of the economy as a whole, the state of the industry and the company’s market performance.

The bottom-up investor starts with specific businesses, regardless of their industry/region, and proceeds in reverse of the top-down approach. Contrarian investors hold that "in the short run, the market is a voting machine, not a weighing machine". Fundamental analysis allows an investor to make his or her own decision on value, while ignoring the opinions of the market.

After determining the economy’s overall direction, investors would then try to specify which sectors or industries might perform best in such conditions and then identify and assess probable individual companies. The senior leadership of a company is another essential qualitative fundamental factor. After all, even the most well-planned strategies can fail if management isn’t qualified to execute them. Therefore, a company needs top-quality people in the lead to implement a business plan or maintain a company’s competitive edge. Analyzing its business model can reveal how the company operates and how it makes money. For example, a newspaper isn’t perhaps making money from subscription fees but instead generates most of its revenues through advertising.

Sources for Fundamental Analysis

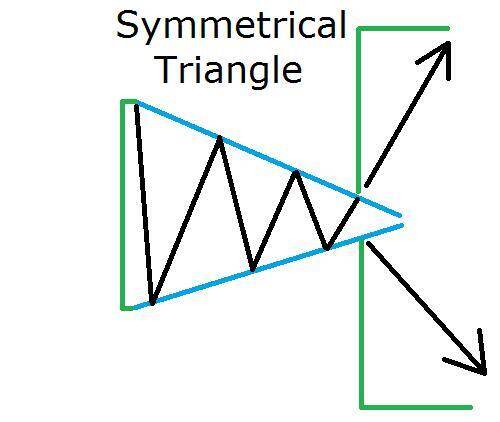

The core assumption is that all known fundamentals are factored into price, thus there is no need to pay close attention to them. Technical analysts do not attempt to measure a security's intrinsic value. Instead, they use stock charts to identify patterns and trends that suggest what a stock will do in the future.

Plenty of Fed and ECB Governors Scheduled to Give Their View - Action Forex

Plenty of Fed and ECB Governors Scheduled to Give Their View.

Posted: Thu, 20 Apr 2023 07:41:37 GMT [source]

It works better in the long term-weeks, months and years, unlike technical analysis, which can be applied even at intervals of a few minutes. Therefore, an investor should resort to fundamental analysis when planning a portfolio for the long term-weeks, months and years. The analysis of a business's health starts with a financial statement analysis that includes financial ratios.

To get a sense of the management of a particular business, it is always a good idea to research the biographies of the team members and find out how they have performed in their previous jobs. Investors looking to create long term wealth should focus more on fundamental analysis. These investors believe that if the sector is doing well, the stocks they are examining should also do well and bring in returns. These investors may look at how outside factors such as rising oil or commodity prices or changes in interest rates will affect certain sectors over others, and therefore the companies in these sectors.

Industry

In the financial world, analysts or whole companies may be tasked with focusing on one over the other, so understanding the nuances of both is important. Top-down and bottom-up approaches are methods used to analyze and choose securities. However, the terms also appear in many other areas of business, finance, investing, and economics.

Rights and Issues Investment Trust – Under new management, same high conviction approach - QuotedData

Rights and Issues Investment Trust – Under new management, same high conviction approach.

Posted: Tue, 18 Apr 2023 15:59:59 GMT [source]

Contrarian investors use fundamental analysis to form their own opinions. They want to decide the true value of a company and ignore the whims of the market. Buy-and-hold investors use fundamental analysis to find stocks with strong foundations. Fundamental analysis can help you understand a company’s foundation. When you pore over a company’s financials, you get a clear picture of where its revenue comes from.

Referred to as fundamentalists, these traders pay close attention to changes in economic indicators such as interest rates, employment rates, and inflation. Top-down analysis starts by analyzing macroeconomic indicators, then performing a more specific sector analysis. Only after that does it dive into the fundamental analysis of a specific firm. It is the opposite of bottom-up analysis, which focuses on looking at fundamentals or key performance indicators before anything else. As we have already said, the top-down approach focuses on the broader picture. That is why to do a proper analysis, we need some macroeconomic factors that can help determine the overall direction of a particular sector or industry.

Fundamental analysis FAQs

The modus operandi observed is that once a client pays amount to them, huge profits are shown in his account online inducing more investment. However, they stop responding when client demands return of amount invested and profit earned. Fundamental and technical analysis provide answers to two very different questions.

The cash flow statement is important because it's challenging for a business to manipulate its cash situation. There is plenty that aggressive accountants can do to manipulate earnings, but it's tough to fake cash in the bank. For this reason, some investors use the cash flow statement as a more conservative measure of a company's performance.

It is quite difficult for small investors to meet in person and evaluate management, but it is possible to study the company’s website and the track record of the top management and board of directors. Pay attention to their past successes and failures, and whether they are buying or selling stock in their company. Qualitative analysis is more subjective because it relies on unquantifiable data.

Therefore, investors can base their investment decisions on their assumptions about what they think is the “right” price – the intrinsic value of the company stock. As a result, an asset or security can either be overvalued, undervalued, or accurately priced. In an economic expansion, interest rates are low, and the economic growth is starting to pick up, investors would invest in businesses that benefit from these conditions. Vice versa, during a recession, the focus would shift to low-risk or non-cyclical stocks. The disintegration of the auto-giant General Motors stocks in 2009 is one of the glaring examples of the risks of ignoring fundamental analysis.

Most often, this methodology is applied in valuing a company’s stock based on its current and projected financial performance. There are several approaches and formulas used in the concept of calculating intrinsic value. In predicting the value of stocks of companies and other financial market assets, there are mainly two types of analysis. Fundamental analysis reflects the value of assets in perspective and, as a rule, it differs from the actual value. It happens that a security is overbought or, on the contrary, undervalued by the market. Accordingly, technical analysis is unable to reflect such a large amount of useful information in choosing assets for an investment portfolio.

Focus on Undervalued Stocks

Schwager and Etzkorn also talk about regression analysis as a statistical procedure to generate forecasts based on the analyzed data. If you are interested in investing in best ‘fundamentally’ chosen stocks then open a FREE Samco Demat account today and get access to the best long term stocks in India. The difficult task is trying to understand what these ratios mean.

Oversupply reduces a fundamental analysis approach’s demand which decreases a company’s overall profitability. Top down Fundamental Analysis first looks at macro-economic factors such as GDP, Inflation etc. Other investors might believe the business is better off being managed by experts in respective fields. This will help the company take tough decisions and always be on top of the game.

- Not only do you have to compare the economies of different countries but also different sectors in the chosen state.

- A common way to model working capital accounts is to use efficiency ratios.

- In predicting the value of stocks of companies and other financial market assets, there are mainly two types of analysis.

- This involves analyzing the market as a whole as well as the macroeconomic indicators of the industry.

It will help you decide whether you are buying shares at a discount or paying extra. Intrinsic value of a company is simply its total assets minus total liabilities. Majority of us believe that fundamental analysis is only for experts. Smart money is the capital that is being invested or withdrawn from the market by knowledgeable financial professionals. Once all these factors are built into an investor's decision, starting from the bottom up, then a decision can be made to make a trade.

If a country has a trade surplus this implies there is a high demand for its goods and services, consequently a greater demand for its currency thus driving up relative value. Similarly, higher relative interest rates lead to cash inflows, thus driving up the value of a currency. Global investors ought to assess the political climate of a country before opting to invest in it.

How to do fundamental analysis?

To understand the growth prospects and financial health of a company. Therefore, it is one of the most effective ways to evaluate investments. DerivativeDerivatives in finance are financial instruments that derive their value from the value of the underlying asset. The underlying asset can be bonds, stocks, currency, commodities, etc. The four types of derivatives are - Option contracts, Future derivatives contracts, Swaps, Forward derivative contracts.

There are two types of fundamental analysis – Qualitative and Quantitative. Qualitative is inclined towards goodwill, market conditions, brand value, and company performance. In contrast, the quantitative analysis is statistically driven. Fundamental analysis is the method to determine the intrinsic value of any security or stock by comparing key ratios to find out a company’s financial health. Lastly, the trader will analyze the company's competitors in a fashion similar to the fundamental analysis already conducted for the company.

Key assumptions of fundamental analysis

https://traderoom.info/ represent the resources the business owns or controls at a given time. This includes items such as cash, inventory, machinery, and buildings. The other side of the equation represents the total financing value the company has used to acquire those assets. Many investors will consider the average of these estimates and assume that the stock's intrinsic value may be near $25. Often investors consider these estimates highly relevant because they want to buy stocks trading at prices significantly below these intrinsic values. The end goal is to determine a number that an investor can compare with a security's current price to see whether the security is undervalued or overvalued by other investors.

“If the intrinsic value is higher than the market price, it is advisable to sell the share.” Buy, surely. Emotional responses of investors to price developments can lead to recognizable price graph patterns. Investors use both analyses, however, for the choosing/buying of shares . Therefore, it is recommended to use fundamental analysis in addition to other methods of forecasting. You can interpret these situations in different situations, but they reflect how fundamental analysis and forecasting works in real-world conditions.

The NAGA Group AG is the holding company of various companies, such as NAGA GLOBAL LLC, NAGA MARKETS EUROPE LTD, NAGA Technology GmbH, NAGA Pay GmbH and has a close link with NAGAX Europe OÜ. All of these help make predictions about whether the value of the chosen financial asset will rise or fall. Ryan Eichler holds a B.S.B.A with a concentration in Finance from Boston University.

MFA Financial, Inc. Receives Moderate Buy Rating from Seven ... - Best Stocks

MFA Financial, Inc. Receives Moderate Buy Rating from Seven ....

Posted: Thu, 20 Apr 2023 11:22:34 GMT [source]

Levi Strauss also increased its quarterly dividend by 20%, to $0.12 per share, which sparked demand for the stock. A P/E score of 5 means that an investor will make $1 profit on an investment of 5. Below, we describe in more detail the three components of quantitative analysis. Top-down analysis generally refers to using comprehensive factors as a basis for decision-making.

Related Courses and Certification

Also Online IT Certification Courses & Online Technical Certificate Programs