Aella introduces daily interest rewards to its customers e-wallets

Aella introduces daily interest rewards to its customers' e-wallets

Aella App, a leading provider of single-point financial services and payment solutions in Nigeria, has launched a new daily interest initiative that rewards customers for simply using the App on a daily basis.

The new product is only accessible via the Aella App and earns daily interest on funds stored in the Aella Wallet. Aella Wallet is an electronic wallet that enables customers to store value while using the Aella App to conduct all financial transactions and earn discounts and rewards.

Daily interest payments are made to customers, with the option of cashing out at the end of the month. Aella Wallet is the first of its kind in the market due to the accumulation of interest earnings.

According to Wale Akanbi, CTO of Aella App, funds held in the Aella Wallet earn interest daily and empower customers by enabling them to access their funds at any time. “We are adamant that our customers deserve credit for their efforts. This is why we are committed to developing revolutionary products that reintroduce power to our customers, rewarding them for simply going about their daily lives. There is no need to lock funds with the Aella Wallet. Our customers can withdraw funds at any time and still receive interest at the end of the month.”

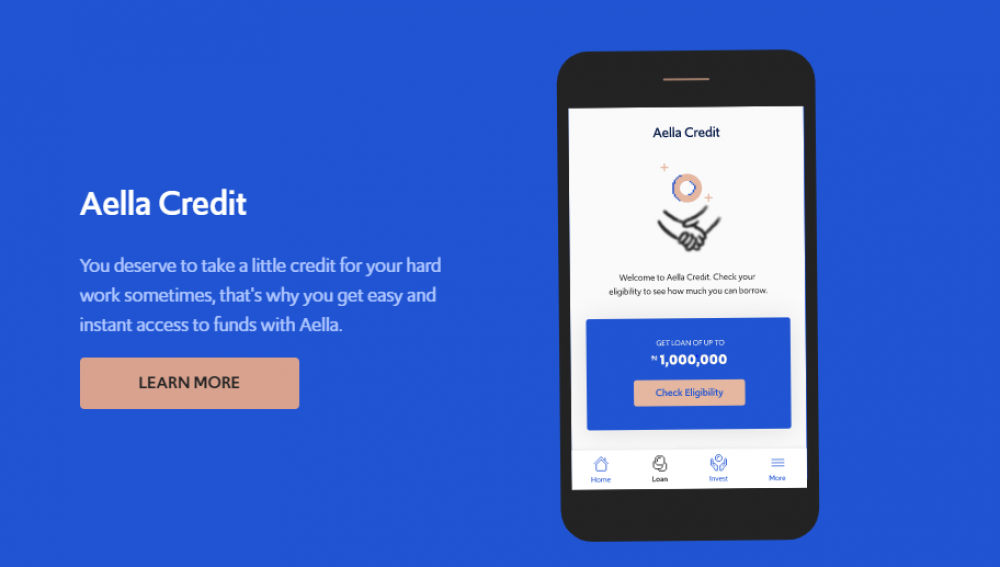

Aella App has also simplified loan and bill payment by providing quick and easy access to loans of up to N1 million on both Android and iOS platforms, with financial services delivered in five (5) minutes. Aella has been strategically positioned to further demystify payment and quick loan impediments in Nigeria and Africa. “Aella is built to simplify instant credit and payment solutions for emerging markets by offering instant loans, bill payments, micro-health insurance, and investment services,” Akanbi explained.

“Our loans range in size from N1,500 to N1,00,000 and have a tenor of 91 to 180 days. Our interest rates range from 2% to 20% for these tenors. Aella offers up to a 30% discount on early repayment and does not charge any agency or convenience fees for bill payments”.

Aella recently received a 'Triple B' investment-grade rating in Nigeria's bond markets, as well as additional funding, and has increased revenue by 624 percent over the last three (3) years. With a target date of 2024 for its initial public offering (IPO), Aella is focusing on a disciplined debt strategy to support organic business growth. The app is available for download via the App Store for iOS or the Google Play Store for Android (Android).

About Aella

Aella is a Financial Technology (FinTech) company founded by two “techno-preneurs” with the goal of simplifying and opening up financial services to support emerging market credit and payment solutions.

With a primary objective of democratizing financial services in order to increase financial inclusion and empower the unbanked, the institution is committed to alleviating poverty and accelerating economic growth throughout the region. The company's vision is to be Africa's one-stop shop for microloans, payments, and financial products and services, by providing a one-of-a-kind experience for customers via a unified payment solution platform. Please visit www.aellaapp.com for additional information.

Courses and Certification

Fintech - Financial Technology Course and Certificate

Android Programming Course and Certificate

iPhone Basics Course and Certificate

iPad Basics Course and Certificate

Mobile Computing Course and Certificate

Mobile Development Course and Certificate

Microsoft Project Course and Certificate