Carbon Collaborates with Visa to Facilitate Payments Throughout Africa

Carbon Collaborates with Visa to Facilitate Payments Throughout Africa

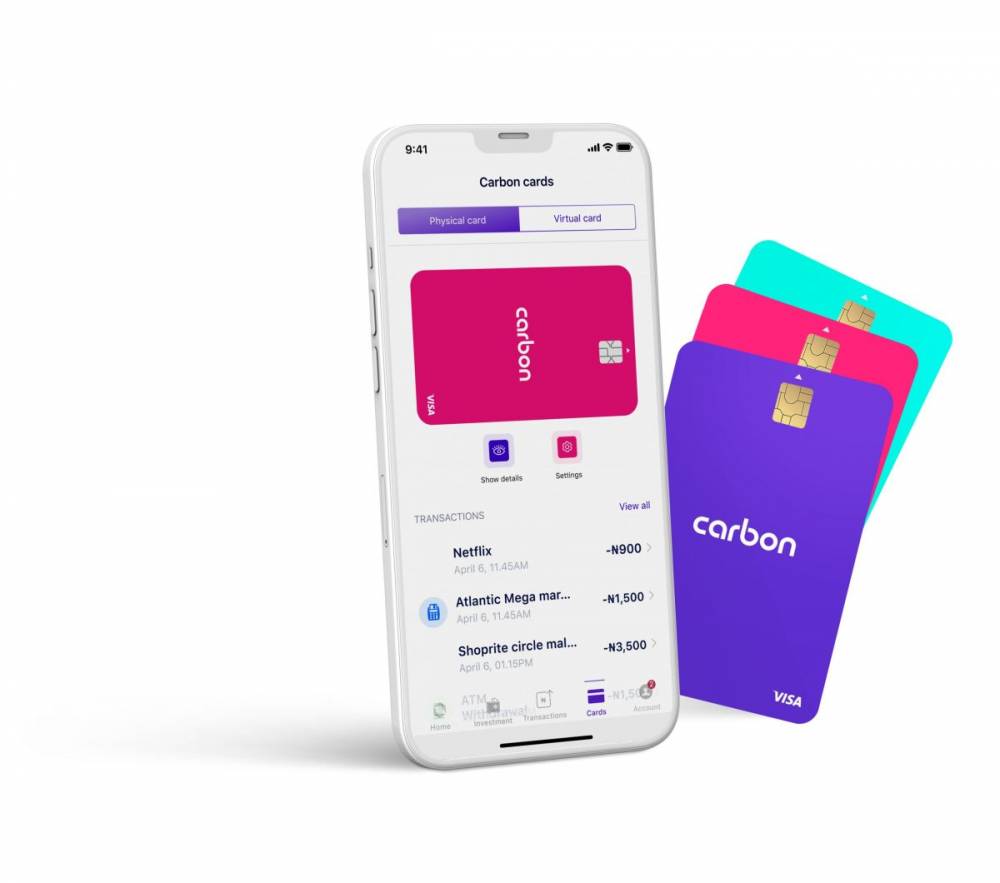

Carbon, a pan-African fintech company that enables Africans to access basic financial services, today announced a five-year strategic partnership with Visa, the world leader in digital payments, to offer its customers both digital and physical Visa cards.

Carbon will launch Visa debit cards in the third quarter of 2021, approximately a year after transitioning from a leading digital lender to a digital bank offering a range of financial services, including savings and payments.

Carbon will implement an instant issuance process in three key markets, including Nigeria, Ghana, and Kenya, by leveraging Visa's payment capabilities.

Visa will provide financial support to both companies over the course of the five-year partnership. The funds will be used to provide implementation and marketing support for Visa's payment solutions across Carbon's products.

“Carbon is committed to providing an unmatched banking experience that is both secure and dependable across all touchpoints,” said Chijioke Dozie, Carbon's CEO/Co-founder. “We want more customers to be able to access some of our most popular products, such as Carbon Zero, via their Carbon card, and our partnership with a leading payments and fintech-friendly company like Visa is critical to accomplishing this.”

Carbon Expansion

Carbon is expanding its user base of over 650,000 customers with the addition of debit cards, following a strong fiscal year in 2020 that saw the company process 96.54 billion ($241.35 million) in payments and 25.21 billion ($63 million) in loan disbursements, eclipsing previous year's numbers despite the pandemic.

“The rapid pace of technological advancement has resulted in a sea change in business and consumer expectations in finance,” said Kemi Okusanya, Vice President, Visa West Africa. “Whether it's revolutionizing how people invest, manage their money, receive loans, or send real-time payments to friends and family, Visa is an ideal partner for fintechs like Carbon, providing them with new ways to reach their customers via Visa's vast network and global scale.”

The addition of Visa cards to the company's payment stack will also facilitate access to Carbon Zero, the company's Buy Now Pay Later product that offers consumers 0% financing on the items they most need but cannot afford immediately.

The partnership with Visa will undoubtedly help Carbon cement its position as a leading digital bank and enable a robust payment experience for consumers from diverse demographics with varying financial needs.

Courses and Certification

Fintech - Financial Technology Course and Certificate

Android Programming Course and Certificate

iPhone Basics Course and Certificate

iPad Basics Course and Certificate

Mobile Computing Course and Certificate

Mobile Development Course and Certificate

Microsoft Excel Course and Certificate